In addition, the equipment can be used to produce new products or services, which can create new markets for the firm. As a result, fixed assets play a critical role in the success of a business. The cash purchase price and sales price of equipment are both shown in the investing section of the cash flow statement.

Purchase & Sale of Equipment Effect on Cash Flow Statement

This cost is objective, verifiable, and the best measure of an asset’s fair market value at the time of purchase. Fair market value is the price received for an item sold in the normal course of business what are operating activities in a business (not at a forced liquidation sale). Even if the market value of the asset changes over time, accountants continue to report the acquisition cost in the asset account in subsequent periods.

Asset purchase

- As it is a credit purchase, it will record the accounts payable as well.

- It is the way that we allocate the cost of purchasing assets to the expense on the income statement.

- But, you also need to account for depreciation—and the eventual disposal of property.

- The equipment is recorded as fixed assets on the company balance sheet.

Rather, the proceeds from the sale are a cash inflow in the investing section of the cash flow statement. However, any gain or loss on the sale must be shown in the operating cash flow section as an adjustment to net income. When you sell at a loss, the selling price is less than the adjusted basis of the equipment.

Exploring 5 equipment finance options

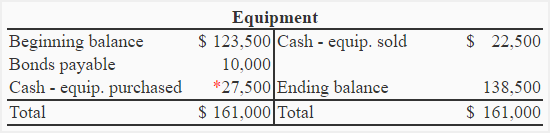

As stated above, cash flows are built into the revenue and expenses portion of the operating section of the income statement. Any cash purchase made in the course of normal operations increases the recorded expenses of the company. The purchase of equipment affects cash flow only if cash is used to pay for the purchase. Financed purchases are considered noncash activities, which only require disclosure in the financial statements. On the other hand, the sale of equipment always affects the investing activities section and the operating section if there is a gain or loss on the sale. The cash purchase of equipment goes to the investing activities section of the cash flow statement.

Legal Fees Journal Entry

The special treatment for gain or loss on sale is only considered when using the indirect method of preparing the operating activities section of the cash flow statement. Computers, cars, and copy machines are just some of the must-have company assets you use. When it’s time to buy new equipment, know how to account for it in your books with a purchase of equipment journal entry.

Get in Touch With a Financial Advisor

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Work performed by a subcontractor that becomes part of the finished product is considered exempt production work. Indeed, navigating the fierce financing landscape as an SMB can seem daunting. Revenue-based financing (RBF) is a type of funding where investors inject capital into a business in exchange for a percentage of future revenue.

It is the efficient use of these resources that in many cases determines the amount of profit corporations will earn. However, if computers are the items that entity purchase, then fixed assets is the account that the entity should be recording into. For cash purchase, entities mostly use petty cash to make payments and for small items only. For larges purchases, they normally purchase on credit and make payments by banks transactions. The totals indicate that the transactions through December 4 result in assets of $16,900.

Second, any gain or loss resulting from the sale should be removed from net income in the operating activities section of the cash flow statement if the indirect method is used. Purchasing equipment on account can be a beneficial move for a business. Making such a purchase allows the business to acquire a fixed asset without needing to pay the full cost upfront. A journal entry can be used to record the transaction, providing an accurate representation of the financial situation. When purchased on account, the journal entry for the fixed asset purchase will include a debit to the Equipment fixed assets account and a credit to the Accounts Payable account.

This division of cost establishes the proper balances in the appropriate accounts. This is especially important later because the depreciation recorded on the buildings affects reported income, while no depreciation is taken on the land. Depreciation expenses are spread out over time, reducing the value of the asset on the balance sheet, while showing on the income statement. This depreciation expense also has tax benefits, such as reducing taxable income. The U.S. tax code uses accelerated methods of depreciation to achieve these benefits. It also increases the liability account if the payment is not yet made.