For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. When making a large cash purchase, it is important to take precautionary measures such as taking multiple forms of identification and seeking out a secure place to make the exchange. Additionally, you should consider alerting law enforcement if you expect to be carrying large sums of money over long distances.

Leasing Equipment Advantages

- Usually this cost includes architect’s fees; building permits; payments to contractors; and the cost of digging the foundation.

- Liabilities and Stockholders’ Equity were not affected by the insurance transaction.

- (Take another look at the last TIP.) While we have not yet identified the second account, what we do know for certain is that the second account will have to be debited.

- Credit purchase helps the company to acquire the necessary items without paying huge cash.

- The special treatment for gain or loss on sale is only considered when using the indirect method of preparing the operating activities section of the cash flow statement.

Office supplies will directly affect the operating expenses in the income statement. Both of these accounts are increasing at the time with the same amount. However, officer supplies are an increase in debt, and account payable is increased in credit.

Sole Proprietorship Transaction #3.

As you can see in the balance sheet, the asset Cash decreased by $14,000 and another asset Vehicles increased by $14,000. Liabilities and stockholders’ equity were not involved and did not change. Debit your Cash account $4,000, and debit your Accumulated Depreciation account $8,000. Now, let’s say your asset’s accumulated depreciation is only at $8,000, but you want to give it away, free of charge.

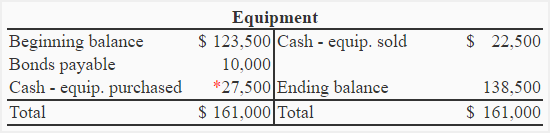

Purchase & Sale of Equipment Effect on Cash Flow Statement

In short, equipment is an essential part of any business and should be given careful consideration before any major decisions are made. The accounting equation reflects that one asset increases and another asset decreases. Since the amount of the increase is the same as the amount of the decrease, the accounting equation remains in balance. Raw material will increase by $ 50,000 on the balance sheet while cash decrease for the same amount. The third sample transaction also occurs on December 2 when Joe contacts an insurance agent regarding insurance coverage for the vehicle Direct Delivery just purchased. The agent informs him that $1,200 will provide insurance protection for the next six months.

Term loans allow you to borrow and repay a lump sum over a set period, usually five to ten years. According to Zippia reports, 82% of small businesses today face the issue of cash availability. For the purpose of this exercise, assume a useful life of 10 years, and that the purchase is made in cash. As you can see, ASC’s assets increase and ASC’s liabilities increase by $7,000. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Record new equipment costs on your business’s balance sheet, typically as Property, plant, and equipment (PP&E). Credit purchase has happened when an entity makes the purchase of goods or services and then makes the payments later. In this case, the entity also needs to records the transaction even though the payments are not made by the supplier yet. As you can see, cash will be reduced since the entity makes the payments to suppliers, and cash should be recorded in credit. Cash purchases have happened when an entity makes a purchase of goods or renders the services and then makes the payments by cash immediately.

When the company purchases the item using cash, they need to record cash decrease and debit assets or expenses which depend on the nature of the purchase. Again, the balance sheet and the accounting equation are in balance and all of the changes occurred on the asset/left/debit side of the accounting equation. Liabilities and Stockholders’ Equity were not affected by the insurance transaction. You also must credit your Computers account $10,000 (the amount you paid for the equipment). But now, your debits equal $12,000 ($4,000 + $8,000) and your credits $10,000. To balance your debits and credits, record your gain of $2,000 by crediting your Gain on Asset Disposal account.

This can include everything from manufacturing machinery, tool, and other equipment. In order to function properly, businesses need to have the right equipment in place. A current asset which indicates the cost of the insurance contract (premiums) that have been paid in advance.

The journal entry should also include any applicable taxes that have been paid to the vendor. If the company purchases raw material, they need to record inventory and cash paid. It includes the finished product which retailer purchases for reselling. On December 2, Direct Delivery purchases a used delivery van for $14,000 by writing a check for $14,000. The two accounts involved are Cash and Vehicles (or Delivery Equipment).

Credit purchase helps the company to acquire the necessary items without paying huge cash. The company can arrange the credit term with the supplier to delay the payment understanding the balance sheet within a certain period of time. Without the credit purchase, the company will not be able to get the necessary items such as inventory, fixed assets, and so on.